2022 Brazilian Série A: Mid-Season Review

Categories: Competition Analysis

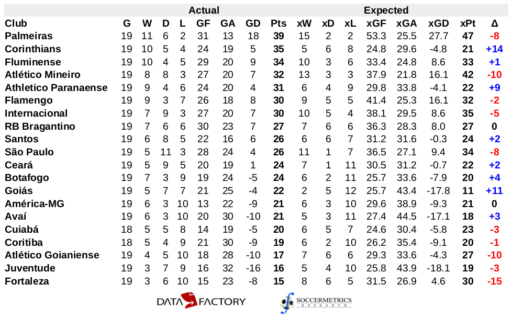

The Brazilian Série A championship has just passed the midpoint of its season. Here is the league table after the Round 19 matches conducted last weekend.

Palmeiras lead the championship by four points from Corinthians, followed by Fluminense, defending champions Atlético Mineiro, Athletico Paranaense, and Flamengo (ahead of Internacional on goal difference). The top six in Série A play in the Copa Libertadores the following season — top four go to the group stage — and the next six play in the following year’s Copa Sudamericana. The bottom four teams in the division are relegated to Série B, and Coritiba, Atlético Goianiense, Juventude, and Fortaleza occupy those spots.

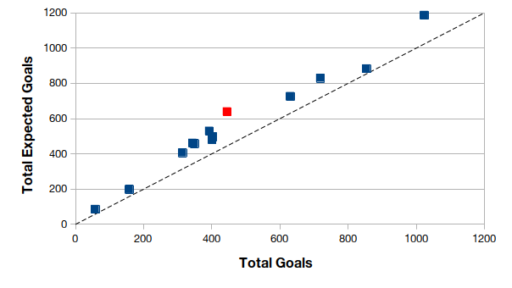

I’ve been working with Brazilian league data for three years now (this is the first season in which I’ve had access to match data from all the matches), and one characteristic that has jumped out at me has been the wide spread between the expected and actual goal statistics. The expected goal metric is a very optimistic metric of goal value, and it is to be expected that the sum of expected goals will exceed that of actual goals to a considerable degree. Over the competitions that I have collected match data, this difference has settled on a range between 15 and 20 percent for league competitions, and 20 to 35 percent for hybrid competitions (group stage plus knockout).

At the midway point of the season, the spread between actual and expected goals is 44 percent. That spread is among the highest measured over the South American competitions that I have studied; only the 2019 Copa América exhibits a larger spread. To be sure, the Copa América is a much smaller competition so the characteristics of such a hybrid competition format might be magnified. But the figure with the Brasileirão provokes questions. Are more shots assigned a higher expected goal value, or is the total number of expected goals larger because there are more shots taken than in other leagues? It’s something to consider, and I’ll consider it in a future post.

Getting back to this year’s competition, Palmeiras have been the dominant team in Brazil. They have taken more shots from open play and dead-ball situations than any other team, they have scored more goals than any other side, they have generated more expected goals than any other side, and they lead the division in xG per 90 minutes and xG per shot. They do not lead Série A in total shots allowed or total expected goals allowed, but they do allow the fewest goals and smallest xGA per 90 minutes. They don’t have the top goalscorer, but they have one of the best midfielders (Gustavo Scarpa), the best attacking defender (Gustavo Gómez), and the best goalkeeper (Weverton). Palmeiras could be in front by a wider margin if their goal conversion rate were closer to the international average of 10 percent, but in general the Brasileirão has a lower shot conversion rate than most leagues (8.69 percent) and Palmeiras is converting at a slightly better than average clip.

The championship remains close because of the exploits of Corinthians. If reality had matched their expected goals, O Timão would be in the lower third of the table trying to fight off the shadows of relegation. At the midway point of the season, only Cuiabá (1.18) had a lower xG per 90 minutes than Corinthians (1.19). Their xGA per 90 minutes (1.42) is almost precisely mediocre for this season. In reality, Corinthians have allowed 7.95 percent of shots taken against them converted into goals, while on the far end of the field, they have converted 11.8 percent of their shots into goals — the best shot conversion rate in the division. Their goalkeeper, Cássio, has been the second best in goals allowed above expectation, Roger Guedes is in the top 20 in goals and expected goals, and Du Queiroz appears to have some promise as a midfielder. Corinthians are dominant on their left flank, and no other team makes more final third touches on the left flank than they.

One surprising side that stands out has been Goiás. By all statistical accounts, this team should be rooted to the foot of the table and starting plans for Série B in 2023. They are in the bottom four in expected goals generated and allowed over 90 minutes, they have made the fewest final third entries — in all flanks! — than any other side. But like Corinthians and Coritiba, Goiás have been highly efficient in their few chances in front of goal. Goiás also have, in Pedro Raul, a very potent striker from open play.

There are so many subplots in the Brasileirão, which is to be expected with a domestic league in a continent-sized nation. Rather than attempt to cover them in one post, I’ll stop here and write about the groups of teams up and down the table in future writings.

Match data used to prepare this post have been supplied by DataFactory Latinoaméricano.